BUSINESS

TraceLoans: Smarter Loan Tracking & Compliance Software

TraceLoans is a loan tracking and compliance software designed to simplify the complexities of modern loan management. In an industry where accuracy, speed, and accountability are non-negotiable, TraceLoans offers a structured and intelligent approach to managing the entire loan lifecycle, from initial application to final approval. Built for financial institutions, corporate lenders, and fintech startups alike, it integrates analytics, automation, and regulation into one cohesive platform.

By enabling systematic control over every phase of the loan process, TraceLoans allows organizations to reduce risk, improve efficiency, and stay compliant with evolving regulatory standards. Its user-focused design helps save time and resources, enabling loan officers and business teams to shift focus from administrative tasks to meaningful relationship-building and strategic decision-making.

Table of Contents

Why TraceLoans Matters

TraceLoans streamlines the entire loan lifecycle by replacing manual processes with an automated loan management system. It enhances regulatory compliance, improves risk management, and ensures real-time loan tracking with built-in audit trails. By centralizing loan servicing, documentation, and borrower data analytics, it reduces processing time and human error. Financial institutions and credit providers benefit from faster approvals, increased transparency, and stronger data integrity, all of which are essential in today’s highly regulated lending environment.

Core Features of TraceLoans

End-to-End Loan Lifecycle Management

Handles every stage, from application and verification to disbursement, repayment, and closure, ensuring smooth and consistent processes across personal, business, and institutional lending portfolios.

Real-Time Analytics and Reporting

Delivers interactive dashboards and granular reports, giving lenders instant insights into loan performance, borrower trends, and potential risks, enabling smarter decision-making and proactive risk mitigation.

Regulatory Compliance Automation

Seamlessly integrates KYC, AML, and audit documentation to meet strict local and global financial regulations without manual oversight, reducing compliance costs and avoiding penalties.

Custom Workflow Automation

Automates approvals, notifications, and document checks with configurable rules, reducing bottlenecks, human error, and operational delays while boosting productivity and enhancing borrower experience.

Integrated Compliance Management for Seamless Lending Oversight

In today’s regulatory environment, compliance cannot be treated as an isolated back-office task; it must be integrated directly into the core of loan operations. TraceLoans embeds compliance management into every stage of the lending process, ensuring that KYC, AML checks, and audit documentation are continuously monitored and enforced. The platform automatically flags irregularities, maintains immutable records, and keeps institutions aligned with evolving financial regulations. This proactive, built-in approach reduces the risk of non-compliance, simplifies audit preparation, and allows lenders to focus on strategic decisions rather than reacting to regulatory setbacks.

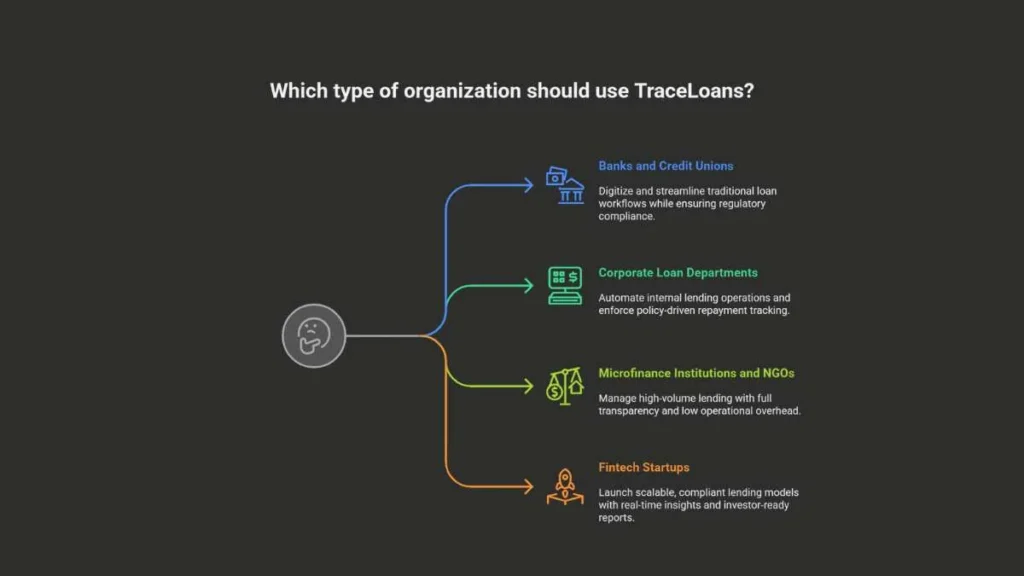

Who Uses TraceLoans?

- Banks and Credit Unions

Digitize and streamline traditional loan workflows while ensuring regulatory compliance. - Corporate Loan Departments

Automate internal lending operations and enforce policy-driven repayment tracking. - Microfinance Institutions and NGOs

Manage high-volume lending with full transparency and low operational overhead. - Fintech Startups

Launch scalable, compliant lending models with real-time insights and investor-ready reports.

Common Use Cases of TraceLoans Across Industries

| Sector | Use Cases |

| Commercial Banking | Retail loans, business loans, loan restructuring, reporting compliance |

| Non-Banking Financial Companies | Installment plans, leasing, and regulatory audit trails |

| Microfinance | Small-ticket loans, group lending, digital onboarding |

| Real Estate Financing | Mortgage management, construction loan tracking, legal documentation |

| Healthcare Financing | Patient credit plans, medical loan processing, HIPAA-compliant storage |

| Agricultural Lending | Seasonal loans, subsidy tracking, and field data integration |

How TraceLoans Improves Operational Efficiency

TraceLoans significantly reduces time-intensive manual processes by introducing automation across workflows, from data entry and approvals to reporting and compliance. Its real-time analytics provide instant visibility into loan status, default risks, and revenue streams, helping decision-makers respond proactively rather than reactively. This results in faster loan cycles, fewer errors, and more reliable financial forecasting. Institutions no longer need to rely on disconnected spreadsheets or legacy software. TraceLoans consolidates everything into a single source of truth.

Benefits

- Increased Accountability: Track user activity and maintain transparency at every stage of loan management.

- Enhanced Decision-Making: Use predictive analytics to assess borrower risk and optimize portfolio performance.

- Time and Cost Savings: Automate repetitive processes and reduce the need for manual follow-ups or audits.

- Scalability for Growth: Grow your loan portfolio without increasing your operational burden or regulatory risk.

- User-Centric Interface: Intuitive design ensures fast onboarding and minimal training for staff and agents.

Future Outlook and Continuous Improvement

TraceLoans is not a static product. It is constantly evolving to incorporate the latest trends in AI, machine learning, blockchain, and regulatory tech. The goal is to create a future-ready solution that grows alongside the institutions it serves.

Upcoming features in the pipeline include:

- AI-based borrower sentiment analysis

- Blockchain-enabled loan authentication

- Enhanced mobile experiences for borrowers

- Embedded financial education modules for clients

This commitment to innovation ensures that TraceLoans stays ahead of industry demands.

Final Thoughts

In an age where regulatory scrutiny is rising and customer expectations are shifting, loan institutions need more than just software they need intelligent infrastructure. TraceLoans answers that need by offering a secure, automated, and compliance-driven system that empowers lenders to do more with less. Whether you’re a growing microfinance firm or a multinational banking entity, TraceLoans adapts to your workflow, enhances control, and supports scalable lending operations that are audit-ready by design.

-

FRIENDSHIP MESSAGES4 months ago

FRIENDSHIP MESSAGES4 months ago100+ Heart Touching Sorry Messages for Friends

-

ANNIVERSARY WISHES8 months ago

ANNIVERSARY WISHES8 months ago100+ Beautiful Engagement Anniversary Wishes Messages and Quotes

-

BIRTHDAY WISHES7 months ago

BIRTHDAY WISHES7 months ago300+ Happy Birthday Wishes for Brother | Heart Touching Happy Birthday Brother

-

BIRTHDAY WISHES8 months ago

BIRTHDAY WISHES8 months ago200+ Unique Birthday Wishes for Your Best Friend to Impress on Their Big Day